Abstract: The main

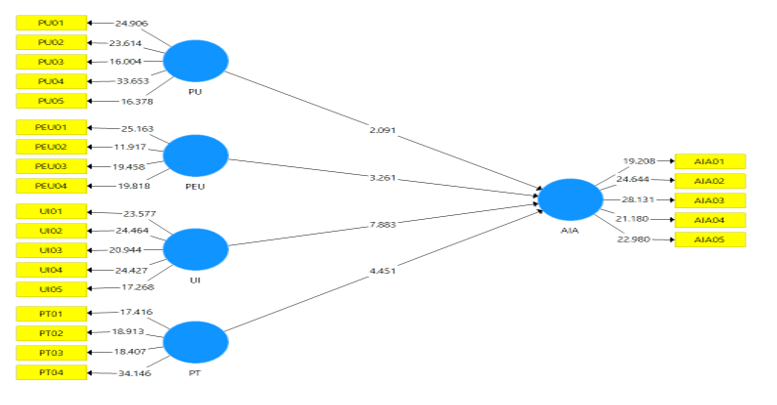

focus of this study is to examine the key factors contributing to consumers'

inclination towards embracing AI within banking services. It further discusses

the moderating role of technology readiness in determining the effect of

perceived usefulness, perceived ease of use, user innovativeness, and perceived

trust on the intention to use AI applications in the banking services. The

research gathered data using a structured questionnaire and non-probability

random sampling methods. Data were collected from 300 private bank customers

residing in two urban cities (Dhaka and Chattogram) in Bangladesh. The study

found that perceived usefulness, perceived ease of use, user innovativeness,

and perceived trust are significantly correlated with behavioral intentions to

adopt AI-based banking services. Simultaneously, technology readiness moderates

the interaction between perceived usefulness and perceived ease of use and

intentions to adopt AI services in banking transactions. The originality of

this study lies in its investigation of AI adoption in Bangladeshi banks by

integrating TAM constructs with user innovativeness and trust, while uniquely

examining technology readiness as a moderator influencing adoption intentions.

Keywords: AI

Adoption, ETAM, Technology Readiness and Banks.